Call Us

+971 50 476 6071

Visit Us Daily

Suite 411, Business Venue Bldg Oud Metha, Dubai UAE.

Message Us

info@mabade.ae

We make this belief a reality by putting clients first.

+971 50 476 6071

Suite 411, Business Venue Bldg Oud Metha, Dubai UAE.

info@mabade.ae

We make this belief a reality by putting clients first, leading with exceptional ideas, doing the right thing, and giving back.

Business Venue Bldg, Suite 411, Oud Metha P.O BOX 47630 , Dubai UAE.

At Mabade, we have built a professional team to provide tax advice and ongoing support to our clients by making a full assessment of the changes that may apply to the company’s legal and organizational structure and business model, in addition to the following list of services which includes:

assisting with completing and submitting the necessary forms and documents, as well as guidance on tax obligations and requirement.

Providing advice on tax strategies to minimize a company's tax liability and preparing and filing tax returns.

Evaluating and advising on the pricing of goods and services between related companies to ensure compliance with tax laws and minimize tax liability.

Ensuring that a company complies with all relevant tax laws and regulations and avoiding penalties for non-compliance.

Representing a company in tax disputes with the government, including audits, appeals, and litigation.

Conducting research on tax laws, regulations, and policies to provide advice on tax planning and compliance.

Assisting with the tax implications of mergers and acquisitions, including due diligence, tax planning, and post-merger integration.

Advising on cross-border tax issues, including transfer pricing, tax treaties, and compliance with foreign tax laws.

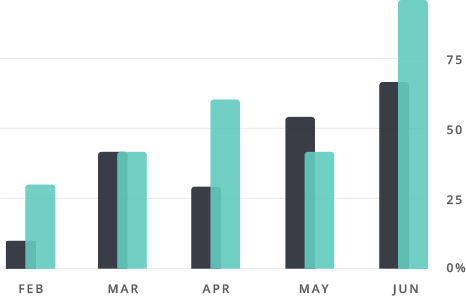

At the year 2022, the Ministry of Finance announced a corporate tax, which will be applied to companies and institutions starting from the middle of this year. Therefore, the profits of companies and institutions will be subject to tax starting from June 2023, and according to the fiscal year of each company.

Since that time, many questions have been arisen about the corporate tax, some of the most frequent questions about include:

These questions highlight the importance of understanding the complex rules and regulations surrounding corporate tax and the need for professional advice to ensure compliance and minimize tax liability.

developing financial processes and procedures

Our specialists are ready to provide an analysis of both the market as a whole and its individual components (competitors, consumers, product, etc.), using practical methods and starting from your research goals.

“I cannot give you the formula for success, but I can give you the formula for failure. It is: Try to please everybody.” david oswald

Suite 411, Business Venue Bldg Oud Metha, Dubai UAE.

+971 50 476 6071

info@mabade.ae